irs unemployment tax refund status phone number

HR Block Maine License Number. 8 Reasons Your Tax Refund Might Be Delayed.

Unemployment Tax Refunds Irs To Send More Payments Before End Of Year Gobankingrates

Your tax refund comes from your 2021 return and the IRS is required to start paying interest on overpayment 45 days after accepting a tax return.

. The mailing address you used on your most recent tax return. Your refund status from the tax year you select. For joint filers provide the same information for your spouse.

This is an optional tax refund-related loan from MetaBank NA. An account number for a credit card mortgage auto loan or personal loan that is in your name. Your date of birth.

In response to the increasing tax-related identity theft problem the Internal Revenue Service IRS is monitoring tax returns for signs of fraudulent activity. Here are 10 of the most common reasons IRS money is delayed this year. Your Social Security number.

Website or on the IRS2GO mobile app. Tax Tip 2022-15 Taxpayers beware. Refund status 800-829-4477.

Fill out you name Social Security number or tax identification number date of birth and address. It is not your tax refund. While using the official IRS Where is My Refund tool Get My Payment tool or Child tax credit portal is the best way to get the status of your official government payments it only provides limited information around current processing and paymentsOn the other hand your IRS tax transcript which can take a while to.

Approval and loan amount based on expected refund amount eligibility criteria and underwriting. 800-829-4933 for businesses with tax-related questions available from 7 am. The most frequent scam is when thieves use a persons name and Social Security number to file a fraudulent return and steal a tax refund.

Does the refund hotline have all of the same information as the Wheres My Refund. At wwwirsgov you can find. Our automated refund hotline 800-829-1954 will not be able to give you your refund status for any year other than the 2021 tax year.

A cell phone with an account in your name. This will be a negative number because from the IRS perspective this is what they owe you. 800-829-1040 for individuals who have questions about anything related to personal taxes available from 7 am.

When the IRS suspects a return is fraudulent the agency will request. Especially when you are anxiously awaiting the status of your tax refund and the official WMRIRS2Go refund status tools are not telling you much. IRS Phone Numbers and Website.

Forms and publications 800-829-3676. When can I start checking Wheres My. Questions about refunds and offsets to IRS liabilities 800-829-1954.

Loans are offered in amounts of 250 500 750 1250 or 3500. Lost IRS check 800-829-1954. With the new tax season starting the IRS reminded taxpayers to be aware that criminals continue to make aggressive calls posing as IRS agents in hopes of stealing taxpayer money or personal information.

If your name or your spouses name was different on last years tax return fill out the name from that tax year. For more find the best free tax software see how to track your refund to your bank account or mailbox and learn how to. The advocate put me on hold then came back to the phone letting me know that all errors have been.

The filing status you used on your most recent tax return. Getting your refund status via your IRS Tax Transcript. An email account and the address.

2021 HRB Tax Group. See terms and conditions for details.

Unemployment Tax Refund Update What Is Irs Treas 310 Weareiowa Com

Where S My Refund Where S My Refund Status Bars Disappeared We Have Gotten Many Comments And Messages Regarding The Irs Where S My Refund Tool Having Your Orange Status Bar Disappearing This Has

How To Find Your Irs Tax Refund Status H R Block Newsroom

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

6 811 Irs Refund Photos Free Royalty Free Stock Photos From Dreamstime

How To Get A Refund For Taxes On Unemployment Benefits Solid State

Tax Refund Timeline Here S When To Expect Yours

Irs Tax Refunds Who Is Getting Irs Compensation Payments Marca

Pin By Lindsay Middleton On Hair Federal Agencies Income Tax Income

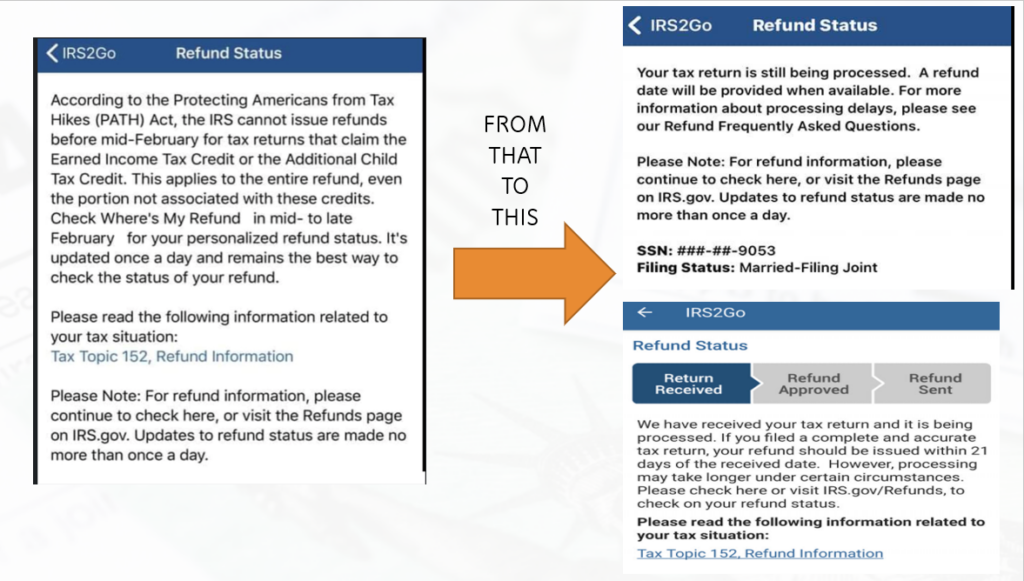

Refund Status Your Tax Return Is Still Being Processed And Refund Date To Be Provided Why And How Returns With Errors Are Being Handled By The Irs Aving To Invest

2 8 Million People Are Getting Irs Refunds This Week 10 Million More May Get Money Too Wbff

2022 Irs Tax Refunds Breaking News New Refunds Released Tax Refund Delays Tax Processing Youtube

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Irs Faces Backlogs From Last Year As New Tax Season Begins Npr

Tax Deadline 2021 Irs Tax Refund Status Where Is It And How Do You Track Your Money With Irs Tools Marca

Irs Phone Numbers Where S My Refund Tax News Information

Millions Of Taxpayers Getting Surprise Bills Revised Tax Statements From Irs Irs Taxes Tax Irs

![]()

What To Know About Unemployment Refund Irs Payment Schedule More